What is repurchase of Stocks? Distinguish between Stock split and stock dividend.

Answer: Repurchasing the shares issued by the organization itself is repurchase of shares. The company repurchases the shares from the amount prepared for dividend distribution to the shareholders. This will reduce the number of shares issued by the company. Shares are repurchased when shareholders have more cash. Shareholders are not taxed when buying shares.

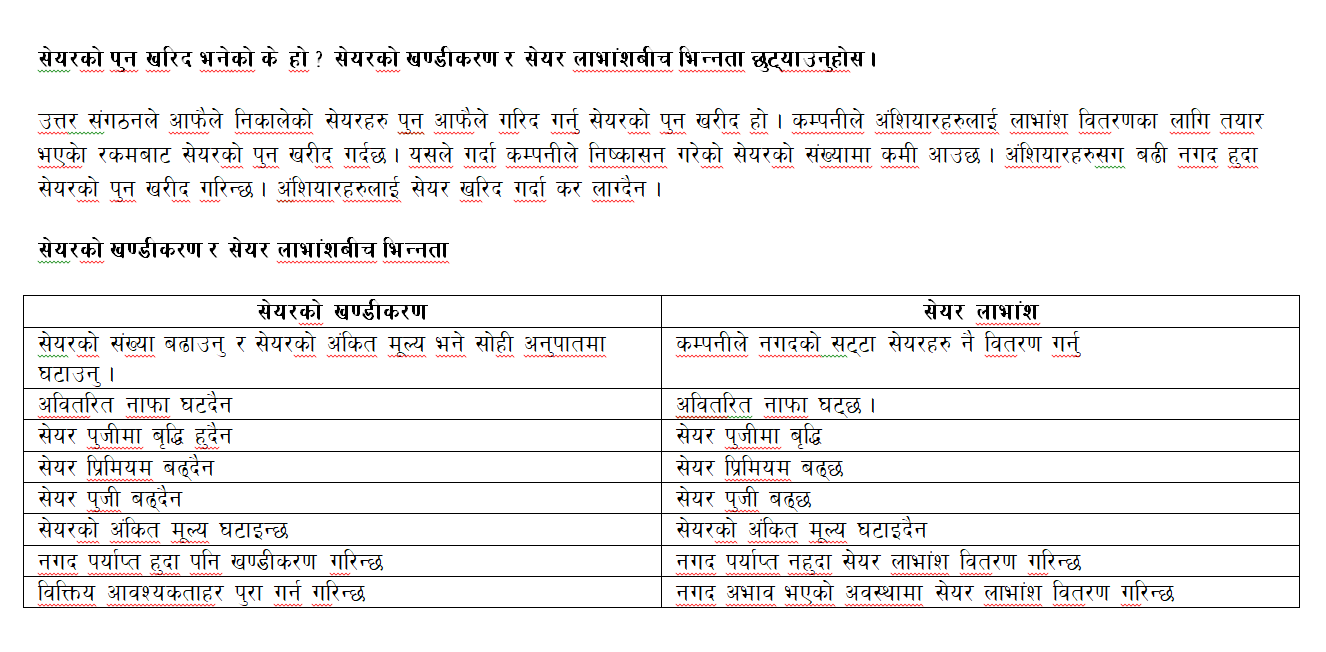

Distinguish Between Stock Split and Stock Dividend.

Stock split |

Stock Dividend |

| Retained earnings do not decrease. | Retained earnings decrease. |

| There is no increase in share capital. | There is no increase in share capital. |

| Share premium does not increase. | Share premium increases |

| Share capital does not increase. | Share capital increases |

| The face value of the shares is reduced. | The face value of the shares is not reduced |

| If there is enough cash, then fractionation is done. | Stock dividends are distributed in case of cash shortage to meet personal needs |

| Increase the number of shares and reduce the face value of the shares in the same proportion. | The company should distribute shares instead of cash. |

What is Repurchase of Stocks? Distinguish between Stock Split and Stock Dividend.

सेयरको खण्डीकरण र सेयर लाभांशबीच भिन्नता