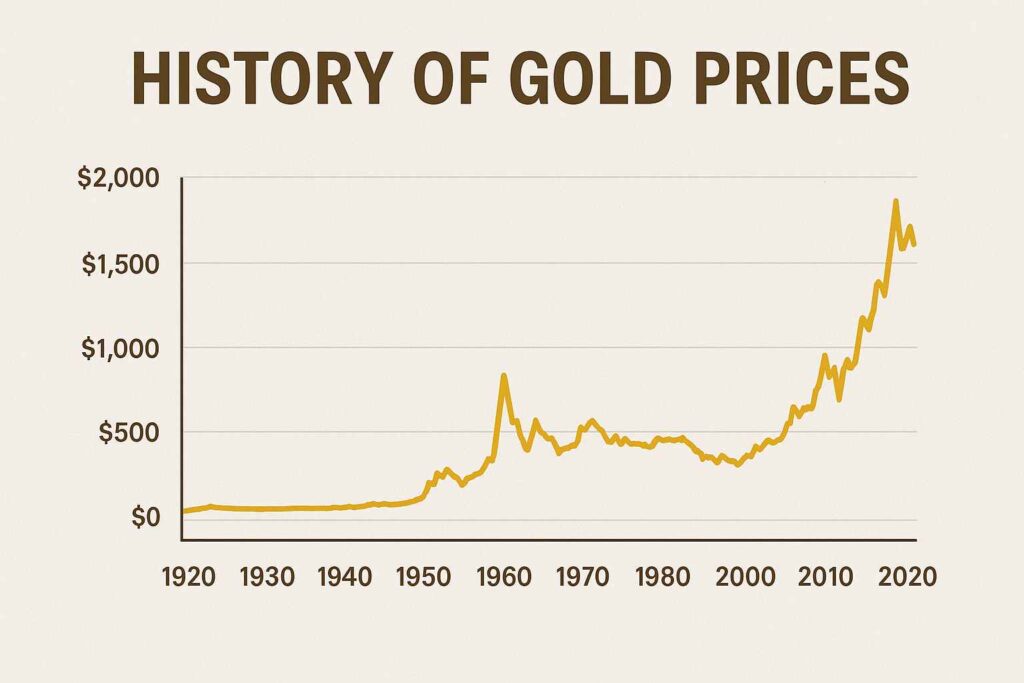

The History of Gold Prices: A Century of Trends and Insights

Gold has long been a symbol of wealth and a reliable store of value. Its price history reflects a dynamic interplay of economic events, geopolitical tensions, and shifts in investor sentiment. This article delves into the evolution of gold prices over the past century, highlighting key milestones and current trends.

Early 20th Century: The Gold Standard Era

At the dawn of the 20th century, many countries adhered to the gold standard, pegging their currencies to a fixed quantity of gold. This system provided stability but limited monetary flexibility. The price of gold remained relatively stable during this period, with minor fluctuations due to economic cycles.

1930s–1970s: The Great Depression and the End of the Gold Standard

The Great Depression of the 1930s led to significant economic upheaval. In response, the U.S. government increased the official price of gold to $35 per ounce in 1934, aiming to stimulate inflation and economic activity. This price remained fixed until 1971 when President Richard Nixon took the U.S. off the gold standard, allowing the dollar to float freely.

1970s–1980s: Inflation and the 1980 Peak

The 1970s witnessed soaring inflation, partly due to oil crises and expansive fiscal policies. Investors turned to gold as a hedge against inflation, driving its price upward. In January 1980, gold reached a then-record high of approximately $850 per ounce, a figure that, when adjusted for inflation, remains one of the highest peaks in its history.

1990s–2000s: A Period of Stability

Following the 1980s surge, gold prices entered a period of relative stability and decline, influenced by a strong U.S. dollar and low inflation rates. Central banks sold off significant portions of their gold reserves, further pressuring prices. By the early 2000s, gold traded below $300 per ounce.

2008–2011: The Global Financial Crisis and Gold’s Resurgence

The 2008 financial crisis marked a turning point for gold. As global markets plunged and central banks slashed interest rates, gold prices began to climb. By 2011, gold reached an all-time high of around $1,900 per ounce, driven by fears of inflation and currency debasement.

2012–2019: Volatility and Recovery

Post-2011, gold prices experienced volatility, influenced by fluctuating inflation expectations and varying central bank policies. However, the metal maintained its appeal as a safe-haven asset during periods of economic uncertainty.

2020–2025: Pandemic, Inflation, and Record Highs

The COVID-19 pandemic in 2020 led to unprecedented fiscal and monetary measures worldwide, including massive stimulus packages and low interest rates. These actions fueled concerns about inflation and currency devaluation, propelling gold prices to new heights. In October 2025, gold prices surged past $4,300 per ounce, driven by factors such as geopolitical tensions, anticipated interest rate cuts by the U.S. Federal Reserve, and a weakening U.S. dollar Reuters.

Factors Influencing Gold Prices

Several key factors influence the price of gold:

-

Inflation and Interest Rates: Gold is often viewed as a hedge against inflation. When inflation rises or real interest rates fall, gold becomes more attractive.

-

Geopolitical Tensions: Events such as wars, trade disputes, and political instability can drive investors toward gold as a safe-haven asset.

-

Currency Movements: A weakening U.S. dollar typically makes gold cheaper for holders of other currencies, increasing demand.

-

Central Bank Policies: Actions by central banks, including gold purchases or sales, can significantly impact gold prices.

Conclusion

The history of gold prices reflects its enduring role as a store of value and a barometer of economic health. From the stability of the gold standard era to the volatility of the 21st century, gold’s price movements offer insights into broader economic trends. As we navigate future uncertainties, gold’s historical performance underscores its potential as a strategic asset in investment portfolios.

For Further Reading: